-

Forecasting Corporate Failure:

A Look at Statistical and Theoretical Approaches

Bankruptcy prediction models are often employed by debtors’, creditors’, or trustees’ experts in litigation to prove or disprove whether a company was, at a particular point in time, in default or expected to default. Understanding the two main types of prediction models – statistical and theoretical – is critical in a bankruptcy setting.

While many kinds of prediction models exist, the vast majority can be classified in two categories: statistical and theoretical. Appreciating the strengths and weaknesses of each can be helpful on a wide range of issues, including evaluating unreasonably small capital tests in fraudulent conveyance claims, assessing the appropriateness of liquidation valuation approaches, and determining retrospective creditworthiness.

Statistical vs. theoretical models

Although most prediction approaches use some form of statistical analysis, purely statistical models are based on the notion that an impending bankruptcy will be visible in deteriorating financial performance. Therefore, evaluating the historical differences in the financial metrics between failed and surviving firms should be informative; these differences represent the symptoms of impending bankruptcy.

Unlike statistical models, theoretical models attempt to predict bankruptcy by focusing on the causes of failure. One well-known example, the contingent claims approach, has gained prominence due to its commercial use by firms like Moody’s, Morningstar, and J.P. Morgan to provide credit-risk analysis. This approach is based on the view that past information may have less predictive power than the information derived from market-based, forward-looking factors, such as stock price and firm valuation.

M. Adnan Aziz & Humayon A. Dar, “Predicting Corporate Bankruptcy: Where We Stand,” 6 (1) CORPORATE GOVERNANCE: THE INTERNATIONAL JOURNAL OF BUSINESS IN SOCIETY 23–26 (2006).

Predictive performance

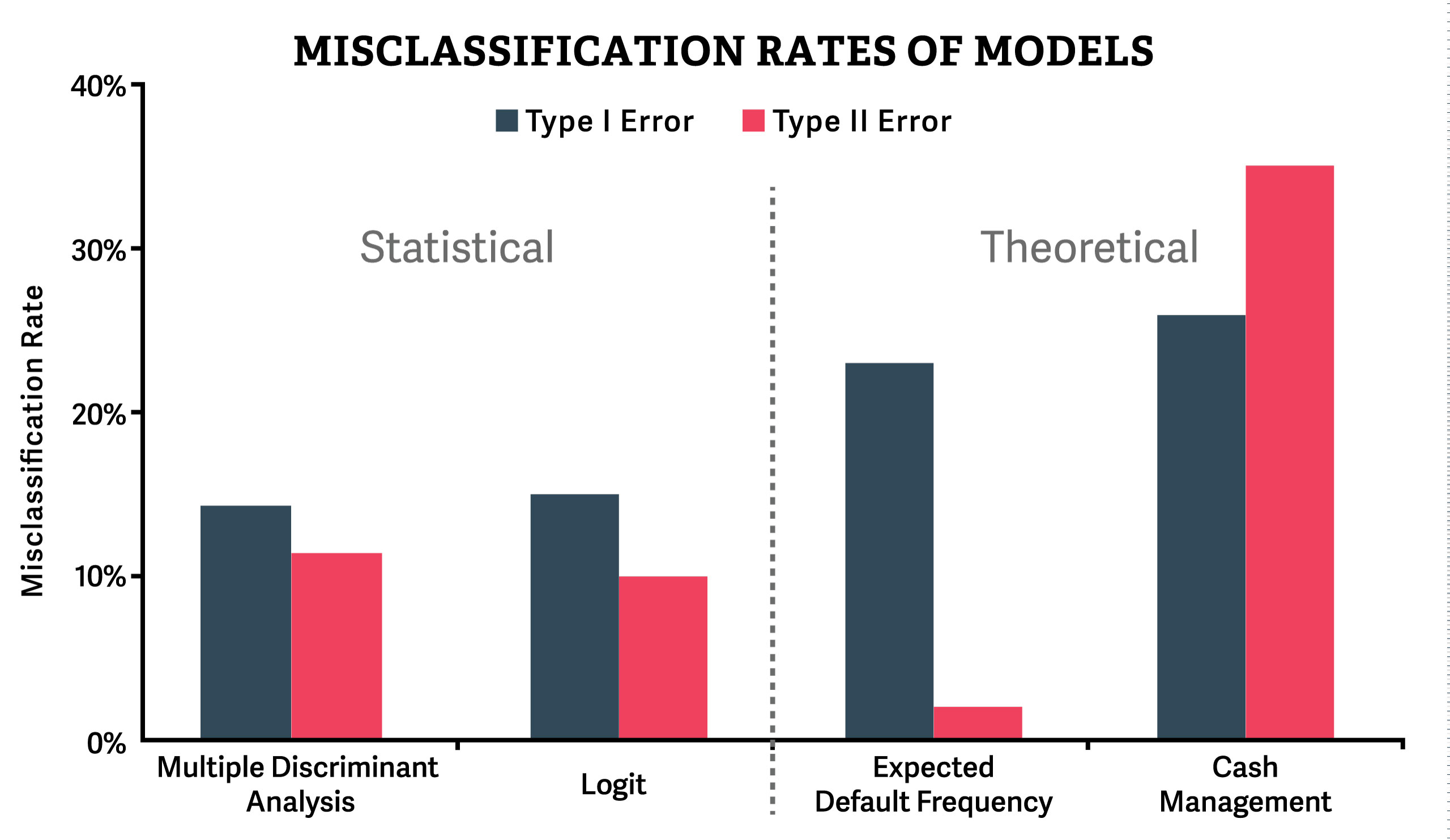

How well do the models actually fare in practice? It is easy to focus only on the ability of a particular model to accurately predict firms that eventually went bankrupt – that is, its predictive accuracy. However, it is also useful to consider the number and type of erroneous predictions that arise as a result of misclassifications. These erroneous predictions can occur in one of two ways: a firm that is predicted to survive actually goes bankrupt (known as a “Type I” or “false positive” error), or a firm that is predicted to go bankrupt actually survives (a “Type II” or “false negative” error).

Despite their differences, all prediction models attempt to answer the same question: at a certain point in time, how likely is a particular company to go bankrupt? Because of differences in rationale, effectiveness, and applicability, each model is suited to answer this question. The applicability of any approach will depend on the context and the details of the particular case. ■

Adapted from “Forecasting Corporate Failure: Understanding Statistical and Theoretical Approaches to Bankruptcy Prediction,” published in AIRA Journal, Vol. 29, No. 1, 2015.

Andrew Wong is a Managing Principal in the Chicago office.