-

Shutdowns, Joblessness, and a Tentative Recovery: Jesse Rothstein on the Impact of the Coronavirus on the US Labor Market

In the wake of the onset of coronavirus-induced state shutdowns, millions of workers lost their jobs or were furloughed. New unemployment claims skyrocketed, and the US unemployment rate rose to levels not seen since the Great Depression. As states carefully weigh the delicate balance between the need to keep their communities safe and the need to reopen their economies, questions abound about the short- and long-term effects of the pandemic on the US labor market.

In this Q&A, Professor Jesse Rothstein, an Analysis Group affiliate, spoke with Managing Principal Jee-Yeon Lehmann about the pandemic’s impact on the US labor market, which workers have been hit the hardest by COVID-related shutdowns, and how a recovery might unfold. Professor Rothstein, the director of the California Policy Lab, served as both chief economist at the US Department of Labor and senior economist on the President’s Council of Economic Advisers (CEA) during the Obama administration.

The coronavirus pandemic has already had a seismic impact on labor markets in the US and abroad. Can you place this in context for us?

Jesse Rothstein: Professor of Public Policy and Economics, University of California, Berkeley; Director, Institute for Research on Labor and Employment

Our understanding of the impact of the pandemic on the labor market is still unfolding, but we can get a sense of the macroeconomic impact to date by examining some key measures of labor market activity. The overall effect on the labor market has been larger than anything we have seen since the Great Depression, and more sudden than anything we have seen in the last century. In the last week of March, just two weeks after the shutdowns began, 6.8 million people filed for unemployment insurance for the first time. That number remained over 2 million in each week throughout May and remained close to 1.5 million even by the end of June. As a comparison point, the highest number of initial jobless claims filed in one week during the Great Recession was less than 700,000.

In the first 15 weeks of this crisis, over 47 million US workers filed for initial jobless claims. This is substantially more than the 39.5 million initial jobless claims filed over the entire 18 months of the Great Recession.

The unemployment rate surged from 4% in March 2020 to almost 15% in May, above the peak unemployment rate in the Great Recession (10%) and exceeded only by unemployment during the Great Depression, which peaked at 25%. The CBO [Congressional Budget Office] has projected that the unemployment rate will decrease by five percentage points to 10% by early 2021 and to 6% by 2025. Personally, I find the CBO’s projection optimistic when we consider it in the light of the slow recoveries we witnessed after both the Great Recession and the Great Depression. It took over three years (12 quarters) for the unemployment rate in the Great Recession to decrease by two percentage points (from 10% to 8%). Similarly, unemployment was still around 20% by the end of 1934, five years after the Great Depression officially began. So a comparatively fast decline now may be expecting too much.

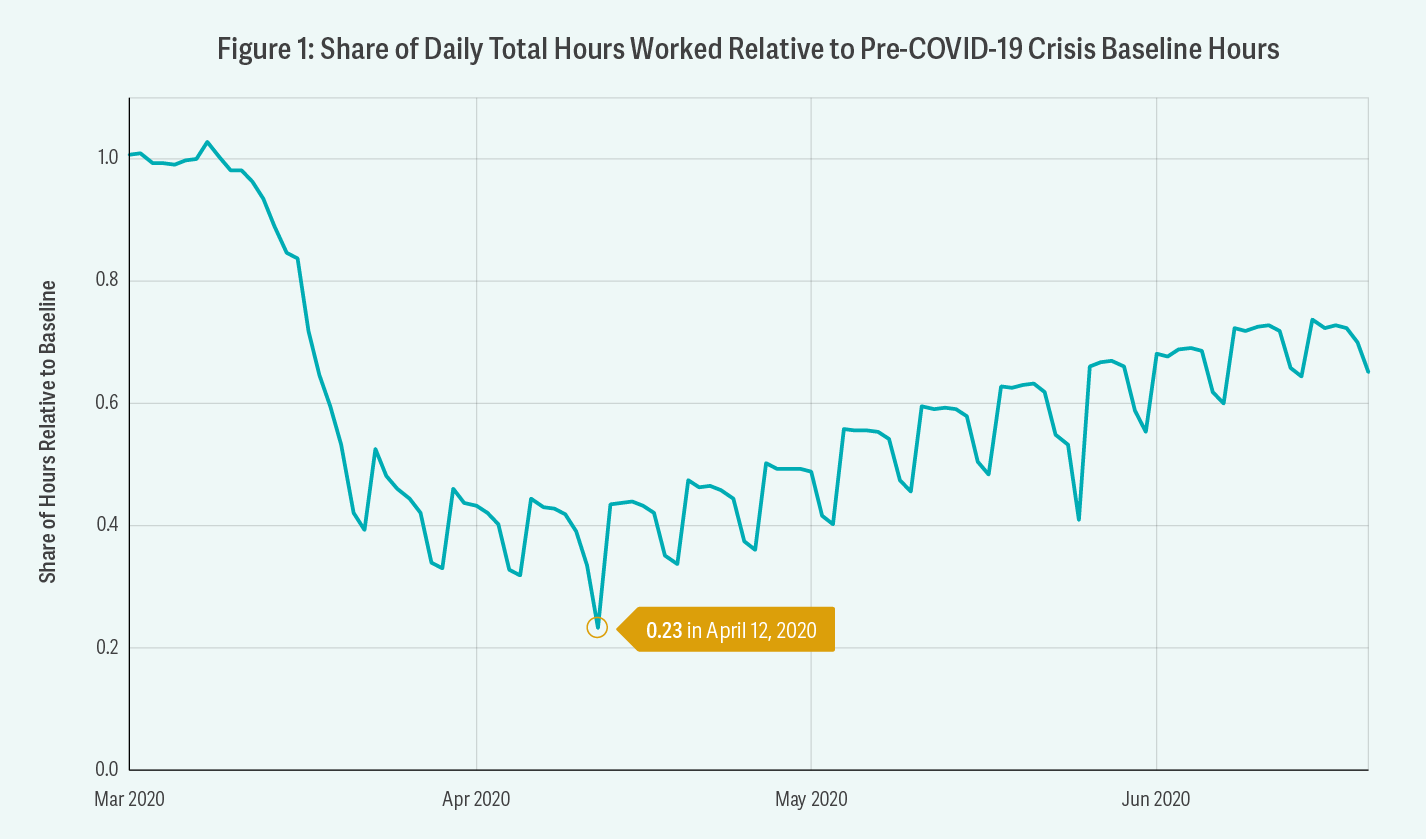

These national unemployment statistics only tell part of the story about how rapidly the labor market collapsed. I am currently working on several different research projects on the COVID-19 crisis with my colleagues using data from Homebase, a provider of time-clock software to small and medium-sized companies. As shown in Figure 1, between the beginning and end of March, the total hours worked at these firms fell by more than 60% compared to the same day of the week in the January 19 to February 1 baseline period.1 Most of the decline occurred in the second and third weeks of the month. Since reaching the lowest point in the middle of April, total hours have grown at a slow and steady pace. By the middle of June, total hours were approximately 60% of what they were at the beginning of March. These data also show clear day-of-the-week effects. Total hours worked – relative to their baseline levels in the same day of the week in January – have been much lower on weekends than weekdays since the start of the COVID-19 crisis. These patterns could reflect several different changes in how businesses are operating, including businesses operating with much-reduced opening hours, or the disproportionate impact of the pandemic on businesses like retailers or restaurants, which had high shares of weekend hours.

Notes: This figure shows daily total hours worked across all firms in Homebase data, as a fraction of average hours worked on the same day of the week in the January 19, 2020, to February 1, 2020, base period. The sample includes firms (defined at the firm-industry-state-NSA level) that recorded at least 80 hours in the base period and excludes Vermont.

Source: Figure is adopted from Alexander Bartik, Marianne Bertrand, Feng Lin, Jesse Rothstein, and Matthew Unrath, “Measuring the labor market at the onset of the COVID-19 crisis,” Brookings Papers on Economic Activity (June 2020), available at https://www.brookings.edu/wp-content/uploads/2020/06/Bartik-et-al-conference-draft.pdf.(“Bartik et al. (June 2020)”), Figure 1B.

What groups of workers have been hardest hit by the pandemic? Have some industries or regions been affected more than others? What factors are responsible for these differences?

It’s true that COVID-19 has not affected all sectors equally. Some groups of workers have been hit much harder than others.

First, the nature of the coronavirus and the stay-at-home measures ordered to prevent its spread mean that sectors where work cannot be performed remotely are more affected than sectors where work can be performed from home more easily. Recent research shows that very few jobs in the agriculture, hospitality, and retail sectors can be performed from home, whereas many jobs in finance, corporate management, and professional and scientific services can be.2 These findings are consistent with findings from my research using Homebase data. Those data show that hours worked declined most drastically in sectors that cannot operate under stay-at-home orders and are not considered essential.

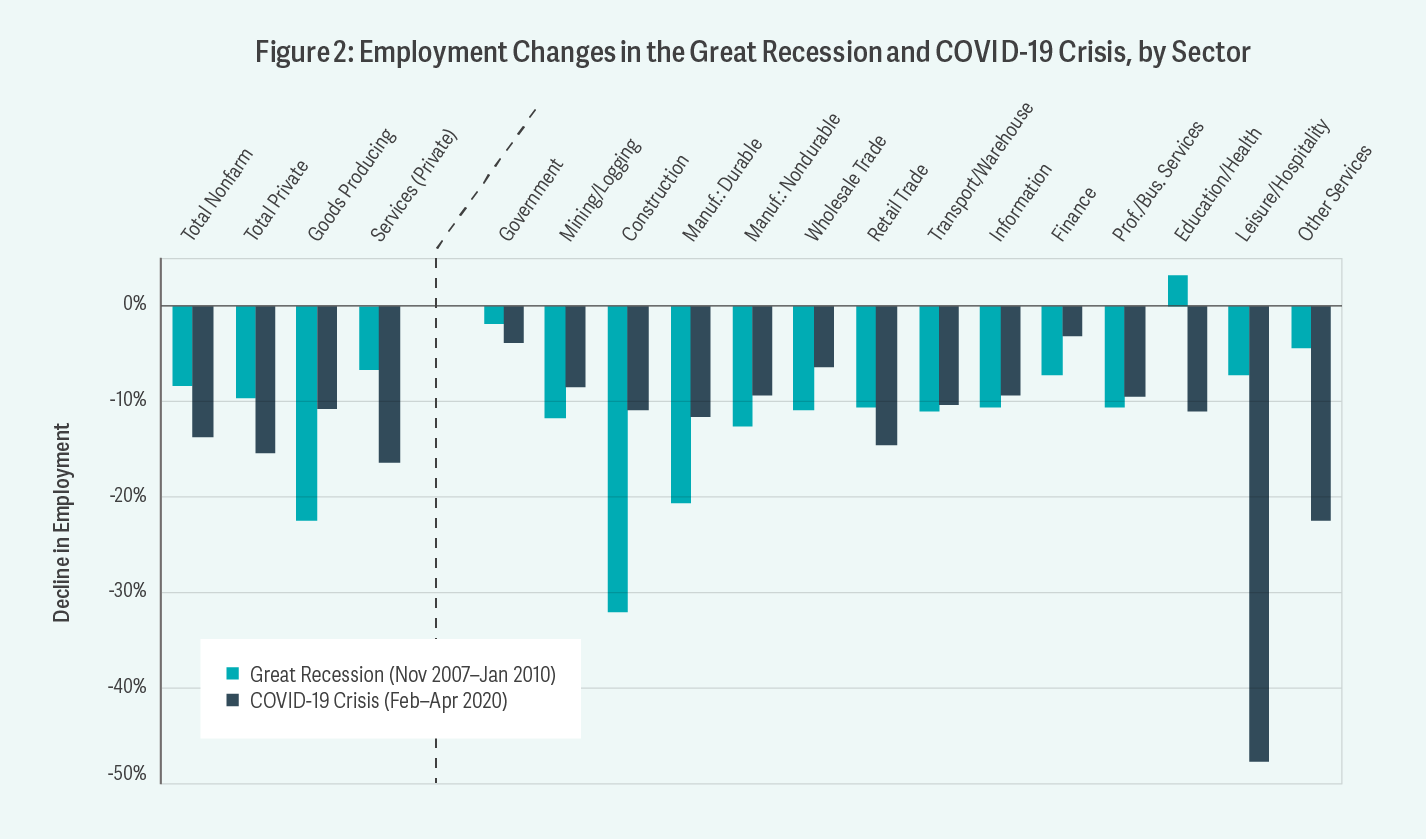

We can also note how the sectoral composition of the COVID-19 crisis compares to that observed during the Great Recession. In a period of two months, from February to April 2020, the US labor market lost 60% more jobs than during the entirety of the Great Recession, from November 2007 to January 2010. (See Figure 2.) There are marked differences in the sectoral composition of job loss. During the Great Recession, construction and durable goods manufacturing experienced the largest declines in employment, whereas the low-wage segment of the private service sector was shielded from the recession.

Second, some geographic areas have been hit harder than others. In the Homebase data, we find that the economic impact of the pandemic shows up in most regions of the country at exactly the same time: the week of March 15 to the week of March 22. But it affects some areas more than others. In particular, areas that never announced shelter-in-place orders had smaller declines in hours worked compared to areas that announced such orders early – even though the orders for the most part hadn’t taken effect anywhere yet. We think such a pattern probably reflects differences in attitudes and in the extent of compliance with social distancing recommendations.

Third, low-wage workers and younger workers with less education have been hit harder than others. The unemployment rate for workers with less than a high school diploma increased 14 points, from 7% in March to 21% in April. By contrast, the unemployment rate for workers with a bachelor’s degree or higher increased six points during the same period. Using the California Unemployment Insurance claims data, we saw that one in three workers from Generation Z (ages 16–23) filed for unemployment benefits; that figure was one in five for workers from Generation X (ages 40–55).3 This finding isn’t surprising given that younger workers are much more likely to work in customer-facing service jobs such as cashiers, waitstaff, etc. These are the jobs that were most directly affected by the shelter-in-place orders.

Notes: Payroll employment by industry or aggregate, from the official Current Employment Statistics release. The first four categories are aggregrates that include many of the remaining series. Not seasonally adjusted.

Source: Current Employment Statistics. Figure is adopted from Bartik et al. (June 2020), Figure 4.

With states gradually continuing to reopen their economies, do you see any unanticipated consequences for labor-management relationships, or the labor market in general?

As the pandemic spread, we saw an increased level of labor organization, centered primarily on worker safety issues. Such concerns led to demands for hazard pay and paid sick leave, and fueled demands for unionization among groups of frontline workers – for example, workers in Amazon warehouses, meatpacking plants, and grocery stores. There is also a growing number of class action lawsuits filed by workers alleging unsafe work conditions and inadequate safety measures. As businesses reopen, more workers are going to face similar workplace safety concerns. It’s estimated that more than 14,000 complaints related to COVID-19 have been filed with OSHA [the Occupational Safety and Health Administration].

This activism has been able to extract concessions from many employers. But I suspect that workers’ leverage will be undermined by a weak labor market. We will almost certainly endure a long period of historically high unemployment. As the economy reopens, some workers will disproportionately face risky work conditions, and many of these workers will be in groups that are already marginalized in the labor markets: poorer workers, women, and workers of color. Historically, the combination of high unemployment and risk being borne by marginalized workers has not given workers a lot of power.

There is also a possibility that the labor-management dynamic will get worse as the supply of workers far exceeds the demand by the firms. We have already seen many health care workers, who are undoubtedly on the front line, face pay cuts as hospitals’ revenues have plummeted because of canceled elective procedures. Several states have also warned workers that they may lose their unemployment benefits if they are called back to work but opt to stay at home because of COVID-19 concerns. I also suspect that the labor-management dynamic may change even further if businesses are temporarily granted liability protection when they reopen.

From a labor economics perspective, what factors will affect the magnitude and the distribution of COVID-19’s ultimate impact on the labor market?

Going forward, there are several critical factors that will impact the size and distribution of the pandemic’s labor market impact.

The first factor is employers’ ability to rehire their former or furloughed workers. Many businesses had to shut down or downsize their workforce through layoffs or furloughs. It is unclear how many of these businesses will reopen, and, if they do, the extent to which they will be able to hire back their workforce is also unknown. If we find ourselves in a situation in which millions of labor market matches remain broken when the economy reopens, both employers and workers will have to expend considerable time and effort to find new matches. This, in turn, will slow down the economic recovery. Our Homebase research has shown that firms that reopened in the first wave in May tended to rehire original employees, but only a portion of their hours were restored.

The second factor is the speed of economic reopening and recovery, which will of course depend on public health developments such as the availability of testing, treatments, and vaccines for COVID-19. You can think of an optimistic scenario in which the recovery is V-shaped: Although the downturn has been large, the recovery will be swift and the economy will bounce back to its pre-pandemic state. But such a recovery will require a sudden and widespread economic resurgence, with most members of the workforce returning to their previous jobs at the same time. We are already observing that this is not how the reopening will occur, so the recovery will likely be more U-shaped, with a longer period of recovery, or checkmarked, with a brief partial recovery followed by much longer and slower crawl back. Even worse would be a W-shaped recovery; if firms reopen and then are forced to close again by a resurgence of the virus, as seems to have happened in June, it may be much harder for them to reopen a second time.

Third, the distribution of the pandemic’s impact on the labor market may continue to disproportionately fall on groups of workers in particular sectors (e.g., entertainment and hospitality), geographic areas, and income strata. Workers newly entering the workforce, older workers who have been laid off, women, and workers of color are also likely to be more affected. Because many of the hardest-hit sectors have a higher proportion of women and low-income workers, these sectors may also be the slowest to reopen. What this means is that previously existing labor market inequalities would likely worsen.

You were senior economist with the CEA in the wake of the Great Recession and have conducted research on its long-term labor market effects. What lessons can you draw from the impact of the recession that are applicable to thinking about potential long-term consequences of the current crisis?

We’ve learned, painfully, that recessions have lasting effects on workers even after the recovery. Studies focused on new labor market entrants – in particular, new graduates entering the workforce at the height of a recession – overwhelmingly show that the economic environment at the time of their entry has a long-lasting negative impact on their lifetime income and employment.4 One possible reason for this is that in good economies, graduates can find jobs that prepare them for their professional careers (e.g., management traineeships), while in bad economies, graduates are forced to settle for jobs without opportunities for advancement. Similarly, the pandemic will force some graduates to enter or remain in sectors that may not best match their skills. These mismatches will reduce productivity and advancement, permanently reducing their earnings and employment rates. Another reason may be that workers’ skills may deteriorate during unemployment.

Moreover, while the literature has focused on new graduates, it is clear that employment hysteresis due to recessions is not confined to them. My colleague Danny Yagan has shown that the Great Recession had significant negative effects on incumbent workers as well.5 His research found that retail workers who worked in areas that were more affected by the Great Recession were less likely to be employed in 2014 – five years after the end of the recession – than those who worked in less-affected areas. Since COVID-19 has already had a large impact on the retail sector, we might expect similar long-term effects on these workers. ■

-

Endnotes

- See discussion in Bartik et al.

- Jonathan I. Dingel and Brent Neiman, How Many Jobs Can be Done at Home? Becker Friedman Institute white paper (April 16, 2020).

- Thomas J. Hedin, Geoffrey Schnorr, and Till von Wachter, California Unemployment Insurance Claims During the COVID-19 Pandemic, California Policy Lab (June 11, 2020).

- Jesse Rothstein, The Lost Generation? Labor Market Outcomes for Post Great Recession Entrants, University of California, Berkeley working paper (July 2020).

- Danny Yagan, “Employment Hysteresis from the Great Recession,” Journal of Political Economy (October 2020).

From Forum 2020.