-

The “Tyranny of Market Shares”: Incorporating Survey-Based Evidence into Merger Analysis

Surveying consumers to better understand the real-world choices they make when evaluating competing products or services can give merger authorities deeper insights into competitive effects.

For regulatory authorities worldwide, a central issue in determining whether to allow a merger to proceed, and under what conditions, is understanding how competition may change post-merger. During their evaluation, regulators such as the Department of Justice (DOJ) and the Federal Trade Commission (FTC) in the US, the Canadian Competition Bureau, and the Directorate-General for Competition (DG Comp) of the European Commission rely heavily on public or internal measures of revenue or unit shares to evaluate potential competitive effects.

Because such measures are often readily available and relatively straightforward to apply, it is tempting to use them to make assumptions about substitutability – that is, how sales may be redistributed across remaining competitors following a merger. The 2010 update to the DOJ’s Horizontal Merger Guidelines underscores the importance of determining substitutability and diversion ratios post-merger, as a measure of the closeness of competition.

However, traditional measures of market share may reflect either overly broad or overly narrow market definitions, or may simply be a poor reflection of competition. These measures only track the aggregated results of consumers’ purchasing decisions, whereas a more accurate understanding of substitutability patterns for specific customer segments may be gained by examining the reasons behind these decisions.

Purchasers make their decisions based on how well a product or a service meets their specific needs. While “best price” may certainly be among those needs, other factors are often involved. (See sidebar.) Quality, availability, experience, level of service, comfort, ease of doing business – the list can be quite long, and the interplay of factors quite complex. Consideration of the complexity of these decisions can reveal that competing products may actually be poor substitutes for one another, even when both are popular and generate large revenues for the competing companies offering them.

In our experience, a user or consumer survey, when expertly designed and rigorously administered, is exceptionally well suited for helping to sort out these kinds of interrelated influences. By providing a better understanding of the decisions and processes behind consumers’ purchasing choices, a survey can help develop a more accurate market definition, and better illuminate the potential competitive effects of a merger.

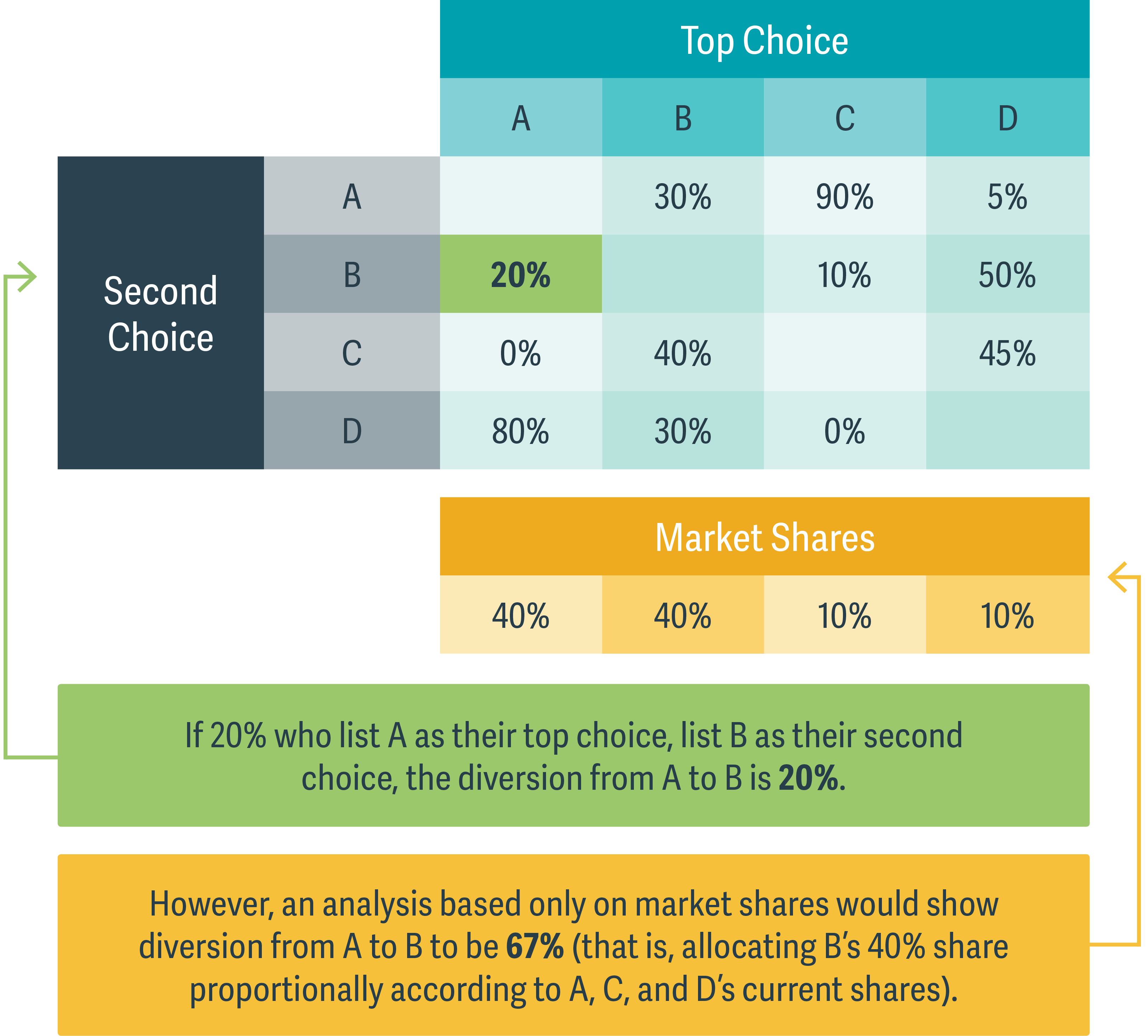

Consider an industry in which companies A and B each account for 40% of revenue in a particular product category, and C and D account for 10% each. In this scenario, analyses relying on reported shares of sales from public sources may initially consider a merger of A and B to be problematic (because they are the two largest competitors), but an acquisition of the smaller company C by A to be fine.

However, some customer subsegments may view A and C to be closer competitors than A and B – these customers consider A, rather than B, to be their “second choice.” (See figure.) Shares based on industry reports or generally tracked statistics, rather than customer survey responses, may not capture these dynamics.

An example of putting this theory into action can be seen in the 2016 Fnac/Darty decision. There, the French Competition Authority (FCA) broke new ground by including both online and offline retail sales of consumer electronics within the same market, rather than just relying on geographical distribution of “brick-and-mortar” stores.

To better understand the nature of competition between online and offline distribution channels, the FCA first commissioned a survey of consumers to study consumers’ shopping habits. It then used the survey results, along with other evidence, to devise a weighted scoring method for calculating market shares and concentration measures, taking into account the relative competitive effects of online vs. offline sales. Ultimately, the FCA allowed Fnac to acquire Darty, but only conditional on the divestiture of a handful of stores in catchment areas that the FCA deemed insufficiently competitive post-merger.

In the litigation world, cases involving trademark infringement, patents, false advertising, collusive behavior, and employment-related class actions have increasingly relied on survey results to illuminate choice decisions. As part of the merger review process, these established survey methods can provide a similar level of insight into relevant competitive dynamics and substitutability. ■

-

Rebecca Kirk Fair, Managing Principal

Rene Befurt, Principal

Emily Cotton, Managing PrincipalAdapted from "The Tyranny of Market Shares: Incorporating Survey-Based Evidence Into Merger Analysis" by Rebecca Kirk Fair, Rene Befurt, and Emily Cotton, Corporate Disputes, July–September 2018

-

Using Survey Data to Assess Hospital Mergers

The extent to which enrollees of commercial health insurers consider merging hospital systems to be close substitutes is an important consideration in assessing potential competitive implications of hospital mergers.

The “diversion ratio” between any two hospitals – the fraction of patients who would go from one to the other if one were no longer available – reflects the extent to which consumers consider the hospitals to be close substitutes. Patient choice models can be used to estimate “choice probabilities,” which can then be used to estimate diversion ratios.

In estimating choice probabilities, it is important to account for patients having different preferences – some patients will care most about going to a hospital that is close to home, while others may care more about specialized services, or the condition of the hospital’s facilities, or a hospital’s reputation. If choice probabilities do not take into account patient heterogeneity, the estimated diversion ratios can be misleadingly high or low.

Patient choice models normally are estimated using hospital discharge data, but survey data can also be used to provide more information about individuals and elicit more information about preferences. Survey data can enable the economist to control for demographic factors such as income and education, as well as for stated preferences such as importance of hospital reputation or convenience. Doing so can allow for more flexible diversion ratios that better account for the potential that patients have different preferences for different types of hospitals.

— Dov Rothman, Managing Principal