-

Exclusionary Abuses and Multi-sided Platforms

Multi-sided platforms have a long history, but the complex economics underlying them have only recently begun to be disentangled by competition enforcers and economists.

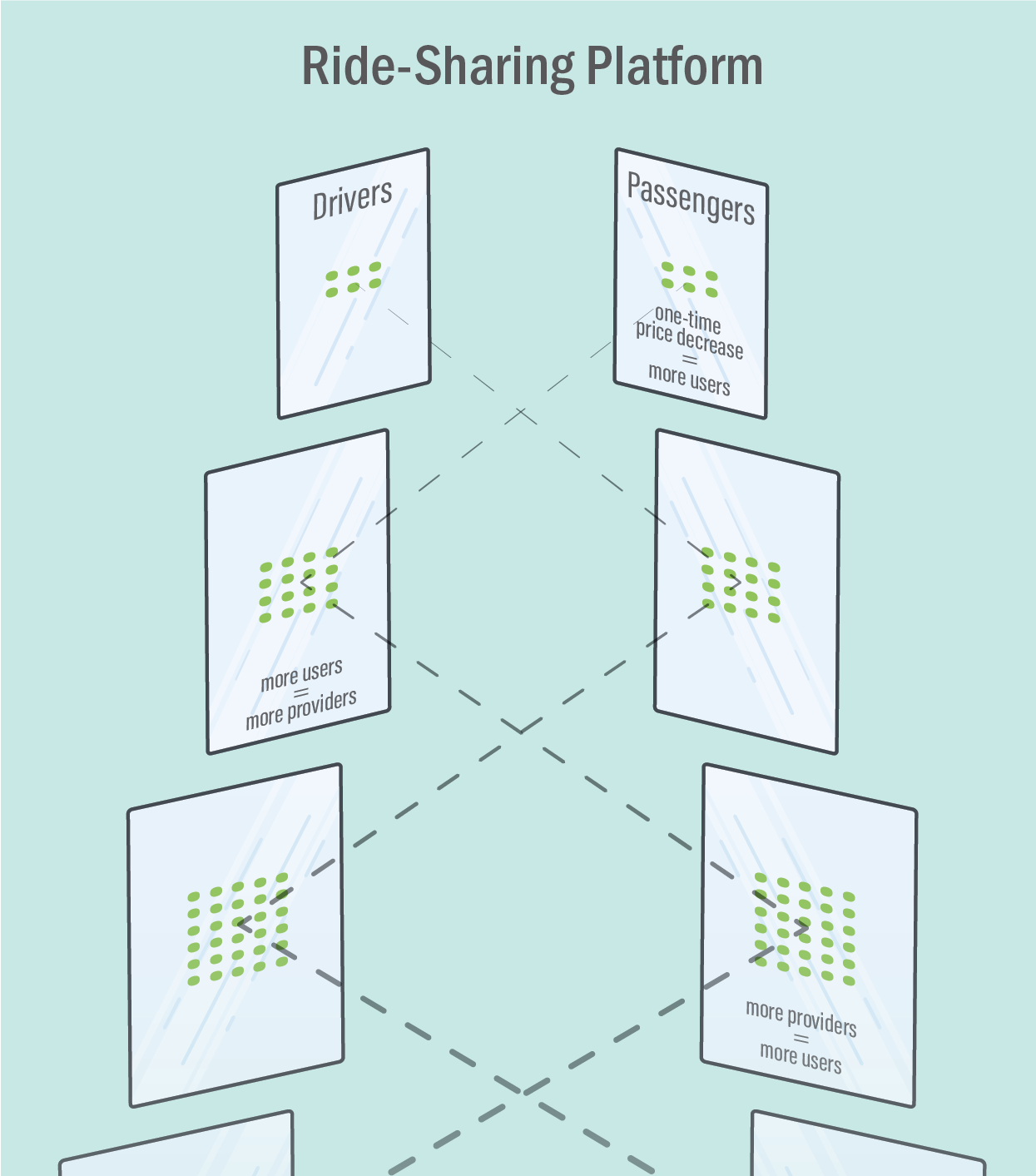

Multi-sided platforms create value by connecting networks of two or more interdependent groups of customers. Without such a platform, the value created by each side would be either greatly diminished or nonexistent. Examples of multi-sided platforms include credit and debit card payment platforms (which connect cardholders with merchants, or issuing banks with acquiring banks), ride-sharing services such as Uber and Lyft (which connect drivers with passengers), and a wealth of e-commerce platforms (which connect software providers, application developers, advertisers, or other products and services on one side with customers on the other).

Although multi-sided platforms were not invented with the internet,1 the rise of technology-based giants such as Amazon, Google, and Apple has drawn increased scrutiny from competition authorities and an associated increase in attention to the underlying economics of these platforms. From both the economics and the competition perspectives, “indirect network effects” are an important component of the complex interactions between the different sides of a platform.

Different views of anticompetitive behavior

The economic issues underlying two-sided platforms, as articulated by Rochet and Tirole in their seminal 2003 paper,2 have recently been at the core of deliberations in important antitrust and merger cases in the highest courts in the US and Europe. Indirect network effects are the result of actions affecting volume, utility, or value on one side of a multi-sided platform that have corresponding effects on other sides. For example, raising prices on a ride-sharing platform is likely to decrease the number of riders, which makes the platform less attractive to drivers. A reduction in the number of drivers, in turn, makes the service even less attractive to riders, and a downward spiral has begun.

Conversely, to create and protect value in a two-sided platform business, it may be optimal to charge a below-cost price to the group that is more price-sensitive. By increasing demand on the one side, demand can be boosted on the other side as well, which serves to increase the overall value or utility of the platform as a whole. (See illustrative figure.) Thus, in many cases pricing below cost on one side of the platform will not represent a per se threat to competition – it simply may be the only way to get both sides on board and ensure that the platform is profitable overall.

In this case, below-cost pricing may not constitute predation. In other words, potentially anticompetitive behaviors in one-sided markets may be procompetitive – and potentially welfare-enhancing – when implemented by multi-sided platforms.

Another example is exclusive dealing clauses. Consider the case of two e-commerce platforms that compete for designer brands on one side and customers on the other. If customers could find the same brands (at the same price) on both platforms, their incentive to “multi-home” and use more than one of the competing platforms would be diminished. In this case, the platform with an initial competitive advantage, no matter how small, would attract all the customers and, given network effects, could drive the temporarily less-attractive competitor out of the market, even though this competitor may, in the long run, be a better alternative.

If, on the other hand, one platform had exclusive access to select brands, a second platform would have incentives to compete for other designer brands in order to stimulate demand on the consumer side. In this way, the two platforms may coexist, competing both for exclusive arrangements with suppliers and for purchases from consumers, potentially leading to greater efficiencies and innovations.

For this reason, although exclusivity clauses in single-sided markets can serve to suppress competition, with multi-sided platforms they may actually be useful for promoting competition by inducing multi-homing between marginally different platforms. This example highlights another fundamental difference between single-sided and multi-sided markets. In single-sided markets, product differentiation mitigates competition, but with two-sided platforms, product differentiation on one side may well foster competition on the other side, leading to greater network effects and greater platform competition.

These conclusions do not imply that multi-sided platforms are immune from competitive harm caused by exclusionary conduct, including predatory prices and exclusivity clauses. For example, pricing below cost on one side of the platform may allow a dominant firm with an established base of captive customers to exclude a smaller but more efficient rival from both sides of the platform.

In addition, in a recent working paper we show that some exclusivity clauses can fundamentally alter the relationship between platform and producer by forcing the former to operate in the risky reseller mode.3 If so, a dominant producer’s market power could pressure a platform to purchase the producer’s output and resell the product on its own, rather than serving as the intermediary “marketplace” for transactions between producer and customer.

Questions for competition courts

Recent high-court decisions in both the US and Europe have revolved around the unique economics underlying multi-sided platforms. In a 5-4 decision from June 2018, the US Supreme Court found for the defendant in Ohio v. American Express Co. The opinion explicitly cited the role of indirect network effects in determining that the two sides of the platform should properly be considered a single market, where value for merchants is inextricably tied up with inducements for cardholders to participate.

In July 2018, the UK Court of Appeal similarly emphasized the importance of properly balancing efficiencies and restrictions on both sides of the two-sided credit card market. The Court of Appeal reviewed lower-court decisions in three cases brought by UK retailers, all of which alleged that the multilateral interchange fees (MIFs) set by MasterCard and Visa were anticompetitive. In finding for the retailers and sending the decisions back for reconsideration, the Court of Appeal specifically assessed whether “the objective advantages of the default MIFs to both cardholders and merchants from increased card usage and efficiencies outweigh the disadvantages of the restriction" 4 to the merchants.

These and other cases have addressed key questions that courts should consider when evaluating any anticompetitive allegations related to multi-sided platforms. Strategies implemented by multi-sided platforms require complex analysis to determine any potential for anticompetitive harm, because what may be anticompetitive in one context may dramatically enhance consumer welfare in another. ■

NotesNotes

- Other "traditional" business that operate on the same principles include shopping malls (connecting different retailers with customers) and airports (connecting travelers with a variety of transportation and retail services).

- Rochet, J.-C., Tirole, J., "Platform Competition in Two-Sided Markets," Journal of the European Economic Association, 1(4): 990–1029 (2003)

- Chapsal, A., Cazaubiel, A., De Nijs, R., Two-Sided Market Dynamics: Theory and Evidence, Working Paper, Universitat Pompeu Fabra, Barcelona (2016)

- Sainsbury's v. Mastercard; AAM v. Mastercard; Sainsbury's v. Visa, at 90

Antoine Chapsal, Managing Principal

Rebecca Kirk Fair, Managing Principal