-

LNG Contracts Taking New Shape in Europe and Globally

Evolving supply and demand factors are leading to a more competitive, globally integrated liquefied natural gas (LNG) market.

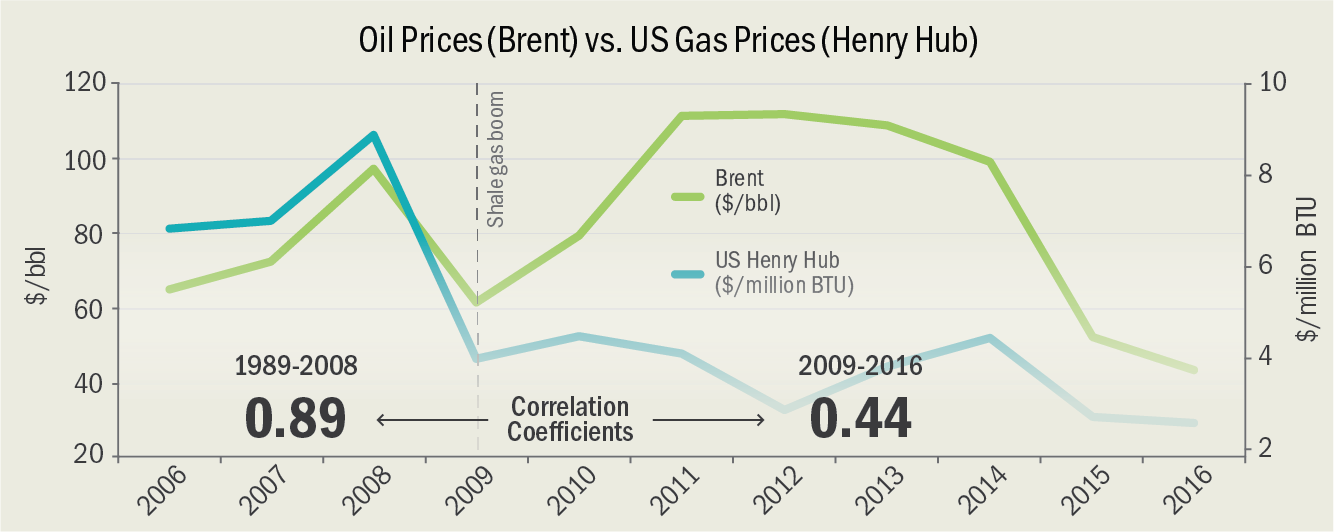

Natural gas is an increasingly globalized commodity due to several factors, including growth in low-cost natural gas supplies from producing regions, particularly from hydraulic fracturing of shale, and greater export capacity for LNG. Over the next five years, we expect to see movements in global natural gas prices become more synchronized with each other, while continuing to be decoupled from crude oil prices in shale gas-producing regions such as the US. (See figure comparing the correlation between US gas and oil prices pre- and post-2009.) We also expect LNG trade to continue to become more fluid and market-sensitive.

New contracts for the supply of LNG have begun to reflect these changes. Prior to the development of shale gas, contracts for LNG typically sourced natural gas from outside the US, were long-term in duration, and linked prices to worldwide oil prices or to natural gas prices in the buyer’s market (and in European contracts, commonly a combination of both). Resale of LNG was strictly prohibited, and volumes were fixed. In contrast, new contracts for LNG today are increasingly sourced from US natural gas and provide for pricing linked to natural gas prices in the seller’s market (typically Henry Hub for US-sourced gas). They also increasingly allow for flexible destinations and volumes, are for relatively shorter periods of time, and allow resale by the buyer.

Existing long-term LNG contracts also typically contain reopener clauses to protect both parties from pricing swings, and to realign prices with both the seller’s costs and general market pricing. The same worldwide market changes have implications for reopeners, where buyers will increasingly shift away from oil-linked prices to the use of natural gas price indices, as has been the trend in Europe (particularly in the Northwest) in the post-shale era.

These market forces will also have spillover effects in related litigation and arbitration where natural gas market fundamentals play a key role, such as commercial disputes over production-sharing agreements, operating agreements, and transportation agreements; shareholder disputes related to disclosures to investors about market conditions; and bankruptcies and reorganizations where the current and forecast value of natural gas plays a fundamental role in valuation.

Note: Years prior to 2006 are not shown on the graph.

Source : BP Statistical Review of World Energy, June 2017, underpinning data.Greater volatility and dispersion in worldwide gas prices will make arbitrage (i.e., transporting natural gas from cheaper markets to more expensive ones) a lucrative opportunity. We expect Europe to continue to be a barometer for the global LNG market, serving as a key market for surplus cargoes and a key hub of price competition between LNG and pipeline gas. ■

Andrea Okie, Managing Principal