-

Capacity Market Impacts of Future Resources Scenarios in the ISO-NE System

The New England Power Pool (NEPOOL), the association of participants in the ISO New England (ISO-NE) wholesale market, annually commissions an Economic Study from ISO-NE. The Economic Study provides the analysis NEPOOL requires to understand the effects that different public policies will have on future energy demand and capacity markets, and in particular the effects on wholesale costs to supply load, on emissions, and on system operability. For the 2016 Economic Study, ISO-NE developed six alternative market scenarios to examine the impact on capacity and clearing price under a range of resource assumptions.

An Analysis Group team, led by Principal Todd Schatzki and including Vice President Chris Llop, contributed to the 2016 Economic Study by modeling outcomes in the forward capacity market (FCM) under each of the six scenarios. The scenarios differed largely in terms of the quantities and characteristics of incremental: (1) fossil resource retirements; (2) new resources used to fill gaps in resource adequacy; and (3) “clean” resources added to the system, defined to include wind, solar, battery storage, imports (hydro), and energy efficiency.

The Analysis Group modeling showed that, across the scenarios, the need for new capacity was driven primarily by retirement of fossil fuel generating capacity. Absent such retirement, net load growth – given energy efficiency and behind-the-meter solar – would be insufficient alone to drive a meaningful need for new capacity. Nevertheless, the scenarios contemplated the addition of new renewable capacity, which, because of its higher cost of entry, would require additional revenue streams from outside of the ISO-NE markets.

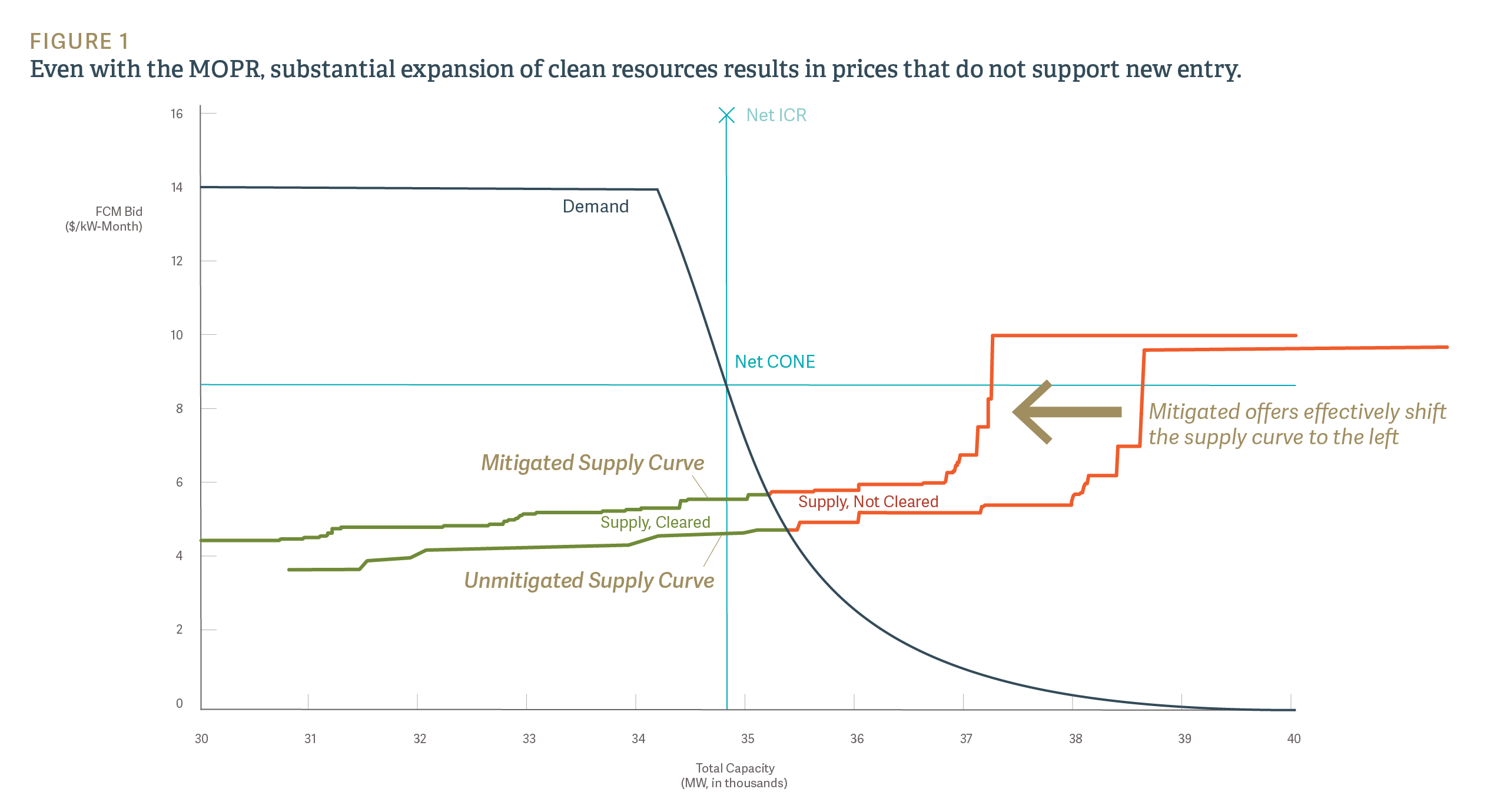

The interactions between the ISO-NE markets and the policies aimed at achieving new renewable entry have raised concerns among many market participants, and have led to active discussions among stakeholders through NEPOOL’s Integrating Markets and Public Policy (IMAPP) process. The Analysis Group work showed that current market rules aimed at mitigating such impacts (i.e., the so-called Minimum Offer Price Rule, or MOPR) would have only a limited impact on clearing prices in the Forward Capacity Auction in certain circumstances, particularly when there is a substantial expansion of clean resources. (See figure.)

The study is being used to inform policy and market decisions under active discussion in the region's IMAPP process. The results of the scenario modeling can help shape state climate and environmental policies, as well as discussions about the interaction between these policies and the ISO-NE markets. ■

This feature was published in June 2017 and is associated with our Energy Infrastructure page.