-

Transformation of the Nation's Electric Infrastructure and Implications for Reliability

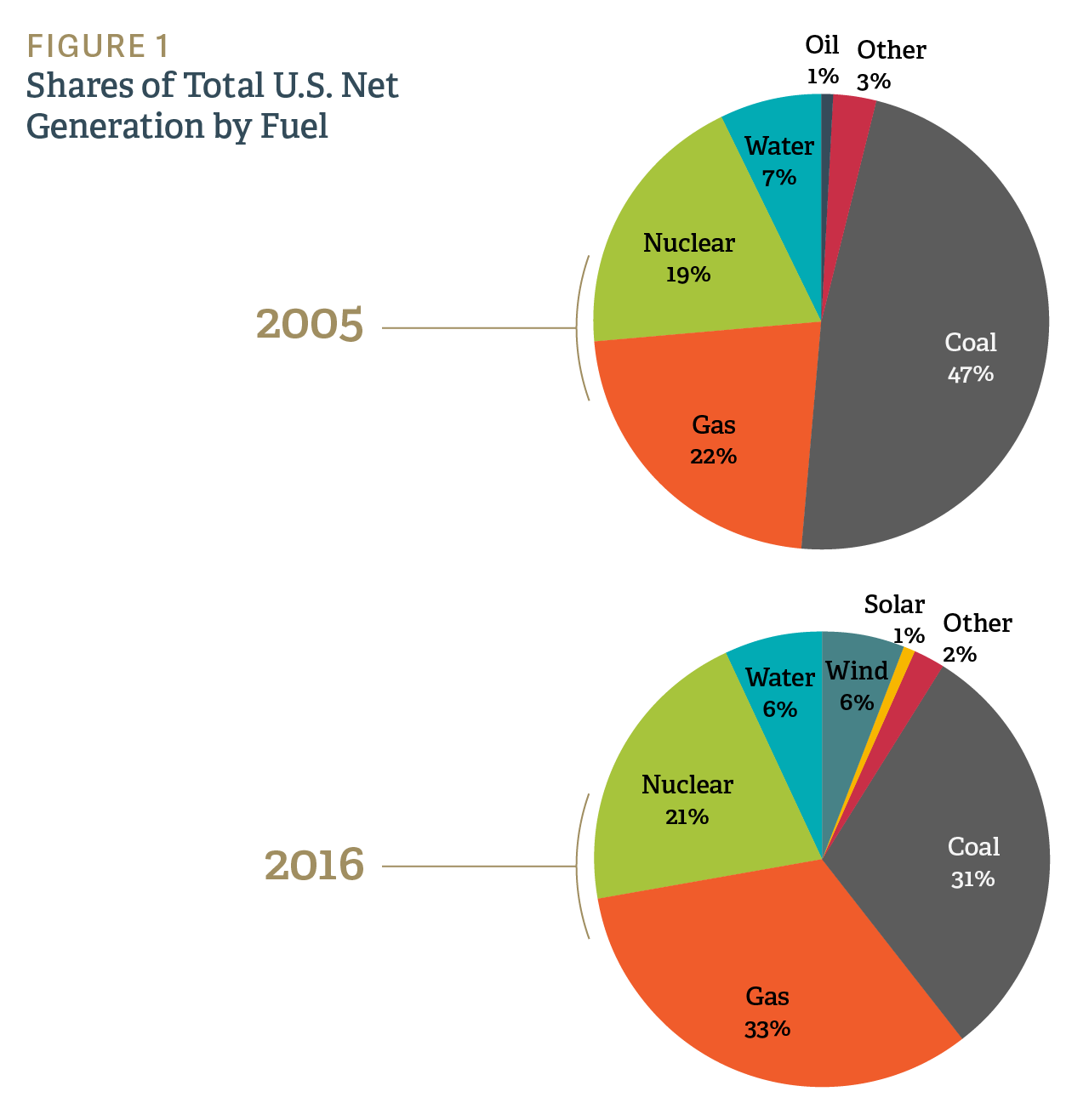

A transition is under way in the US electric industry, evolving the power mix away from older, inefficient capacity and toward a new mix of energy infrastructure. New gas-fired and renewable generation facilities have added significant capacity over the past 15 years, driving the transformation of the industry by lowering wholesale electricity costs in most parts of the US, diversifying electricity supply, and helping lower consumers’ cost of living overall.

This latest phase in the ongoing evolution of the electric industry also has triggered numerous investigations into the drivers behind the current transformation, and the potential impacts of a changing resource mix on power system reliability.

These issues are assessed in a recent report by Analysis Group Principal Paul Hibbard and Senior Advisor Susan Tierney. In Electricity Markets, Reliability and the Evolving U.S. Power System, the authors conducted a comprehensive review of the factors driving the profitability and investment/retirement decisions of power plant owners and developers, and investigated how a changing resource mix affects the ability of power system operators to ensure operational reliability of the grid over the near and long terms.

The authors conclude that fundamental market factors are driving the change in the nation's mix of electric generation infrastructure. By far the most significant driver is the addition of new, highly efficient gas-fired resources since 2000, combined with a precipitous drop in natural gas prices due to the emergence of shale gas. This has put financial pressure on many older power plants (including not only coal-fired units, but also older gas-fired and nuclear units), particularly for merchant plants in those regions that administer organized and competitive wholesale markets for energy, capacity, and/or ancillary services. While a distant second to the impact of natural gas pricing, additional factors – including flat electricity demand and the emergence of variable renewable generating capacity – have also impacted the revenues of merchant generators, especially those without long-term contracts and those in PJM, NYISO, and ISO-NE markets.

The authors also observe that the transition under way in the electric resource mix is not harming reliability. The addition of newer, more technologically advanced and more efficient generation technologies that use gas and renewable energy is rendering the power systems in this country more, rather than less, diverse. (See figure.) These newer resources also are contributing to the varied reliability services – such as frequency and voltage management, ramping and load-following capabilities, provision of contingency and replacement reserves, black start capability, and sufficient electricity output to meet demand at all times – that electric grids require to provide electric service to consumers on an around-the-clock basis. Consequently, the evolving portfolio of electric-system assets continues to preserve power system reliability.

The authors conclude that is it always prudent for observers and participants in the power markets to assess the reliability implications of changes in the system, but to view such assessments as part of the normal process of assuring system security rather than an indicator that reliability problems will actually transpire. ■

This feature was published in June 2017 and is associated with our Energy Infrastructure page.