-

The Economics of Different Ownership Structures for Water Utilities: Investor-Owned vs Government-Owned

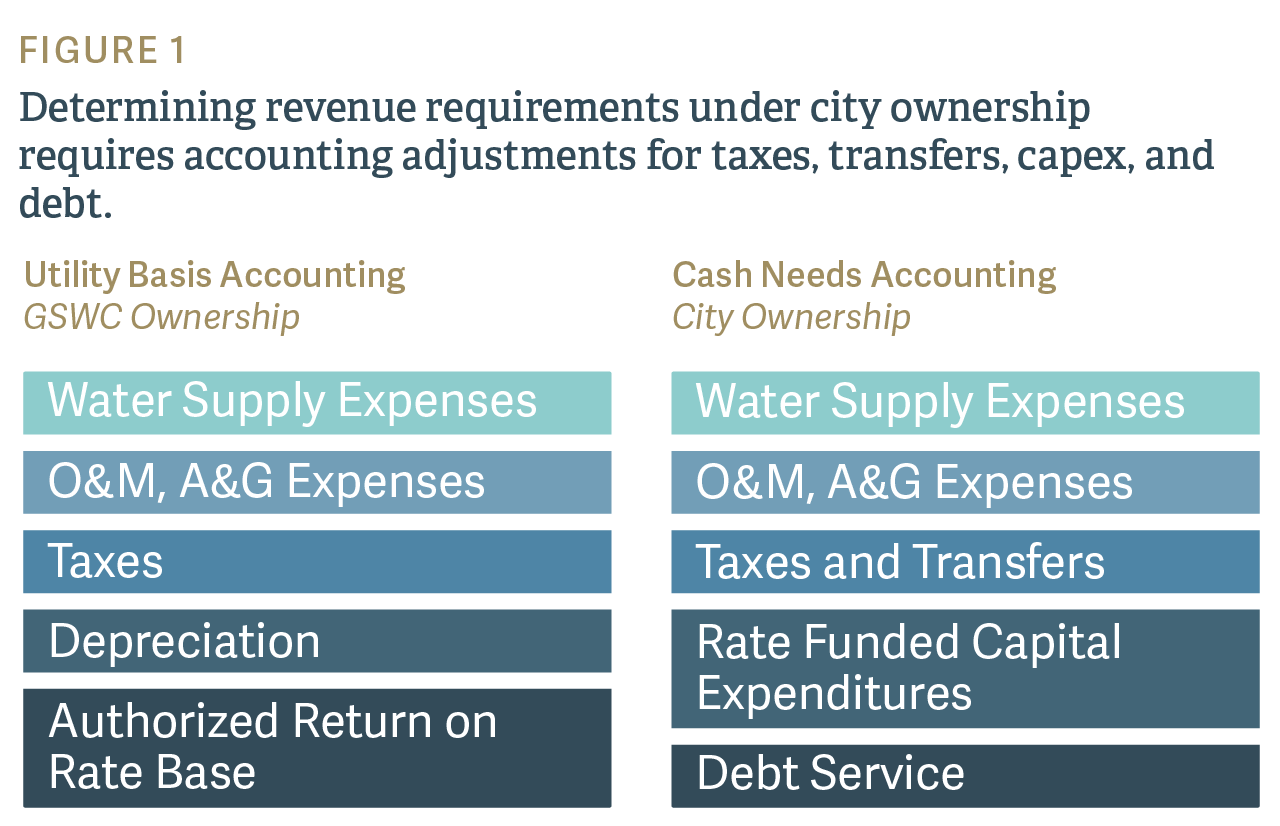

Proponents of government ownership of water utilities typically claim that municipal operation is more beneficial to customers than private operation. These types of claims were recently tested in the first eminent domain case involving an investor-owned water utility in California state court, in which the City of Claremont brought suit against Golden State Water Company. An Analysis Group team, led by Principal David Sosa and Manager Tracy Danner, supported affiliated experts Dr. Michael Hanemann and Mr. Stephen Peters in developing testimony and analysis on behalf of Golden State Water. The team also provided consulting support to Golden State’s counsel, Manatt, Phelps & Phillips. A part of this analysis highlighted how differences in financing and cost accounting between an investor-owned utility and a city-owned utility affected ratemaking. (See figure.)

Testifying at trial, Dr. Hanemann presented an economic feasibility model comparing the expected impact on ratepayers under City ownership relative to continued Golden State ownership. Dr. Hanemann also opined on the benefits of economic regulation by the California Public Utilities Commission (CPUC), particularly as it provides incentives to make long-run investments in water system infrastructure for the benefit of customers. Mr. Peters’ testimony pertained to the City's anticipated issuance of water revenue bonds to finance the acquisition, and included an overview of the conditions and mechanisms that market participants would use to monitor the City's performance against those obligations.

Ultimately, the judge concluded that Golden State had demonstrated that Claremont residents would be better served if the company continued to own and operate the water system under economic regulation by the CPUC. In his final order dismissing the City's eminent domain complaint, the judge wrote that he was “persuaded by the testimony and analysis given by Stephen Peters and Dr. Michael Hanemann that the [City's cost of acquiring the water system] … will require increased water rates.” Furthermore, the judge rejected the City’s argument that “‘local control’ is inherently better than the process that the Legislature has imposed to regulate the rates, practices and investment decisions of investor-owned utilities.”

Additional work done by Dr. Sosa, sponsored by the California Water Association, has demonstrated that government authorities often overestimate the cost savings achievable through government ownership (e.g., through differences in cost of capital and taxation issues), and may fail to account for such factors as the capital investment required to maintain service quality. (For example, see The Economic Consequences of Contested Government Takeovers of Investor-Owned Water Utilities.) As municipalities consider whether water customers would be better served by an investor-owned or a government-owned utility, it will be important to accurately account for differences in cost allocation, infrastructure funding, and tax and revenue consequences.

This feature was published in June 2017 and is associated with our Energy Infrastructure page.